Home buying can be a thrilling adventure. But, like any other major life decision, it can also be a bit overwhelming and stressful. Fortunately, there are many things you can do to make your experience easier and more enjoyable.

One of the most important is to be realistic about your budget. This will help you avoid falling in love with homes that are out of your price range, which can lead to house hunt burnout.

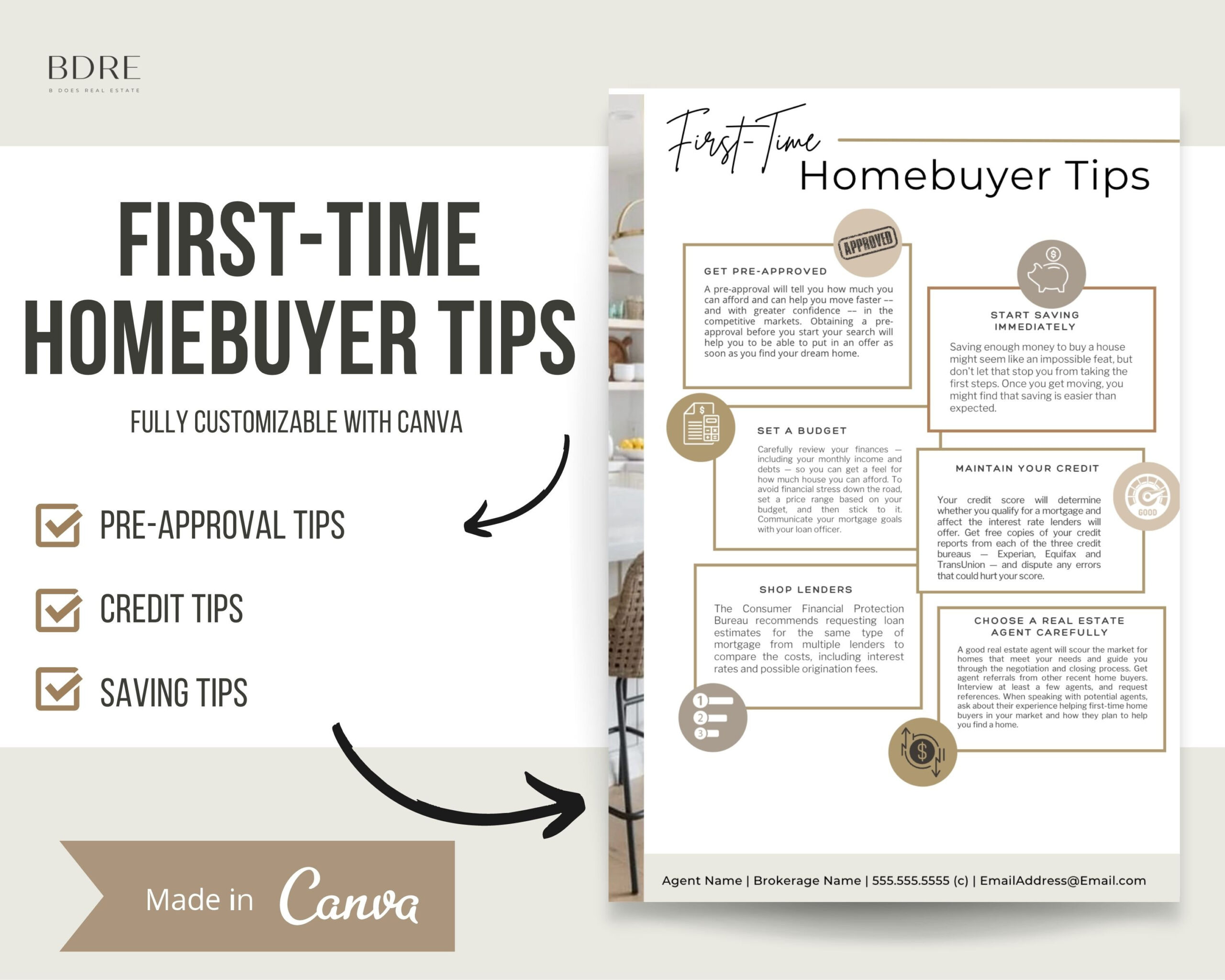

1. Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is the first step in home buying. The process involves a lender reviewing your credit history and financial situation to determine how much you can afford to spend on a home. The lender should then provide you with a document called an official Loan Estimate within three days of receiving your completed mortgage application. The loan estimate includes a breakdown of the type of mortgage you have been approved for, including the total amount you’re eligible to borrow, your estimated interest rate and monthly payments, and the cost of homeowner’s insurance and property taxes.

The best time to get pre-approved is before you start house hunting. This will help you narrow down your search and avoid spending time looking at homes that are out of your price range. It also shows sellers that you’re a serious buyer and can move quickly when you find your dream home.

Once you find the right home, make an offer based on the loan amount you have been pre-approved for. Keep in mind that your pre-approval may expire after a certain period of time, usually 30 to 90 days. If this happens, be sure to get it renewed so you don’t end up in a situation where you find the perfect home only to discover that your mortgage isn’t approved. You may be able to extend your pre-approval by showing that you’ve been diligent in saving money and meeting other requirements, such as the ability to make a down payment.

2. Know Your Budget

Searching for your dream home doesn’t have to be a stressful, time-consuming process. If you approach it with a clear plan in place, your journey to homeownership can be much smoother. Before you start browsing real estate websites or attending open houses, get a pre-approval for a mortgage and make a list of the non-negotiable features that you want in your new home. By keeping these details in mind, you can focus your efforts while searching for the best possible deal and avoid getting sucked into a bidding war or falling in love with a house that’s over your budget.

You may also find yourself debating between the location and the actual property. It’s easy to fall in love with a house that’s just within your price range, but that’s a dangerous game to play. Eventually, you’ll end up purchasing a home that you don’t truly love, or that could be better suited to your needs with some minor renovations.

Don’t overlook homes in less popular neighborhoods, either. Many buyers have found their perfect home by looking beyond the typical housing options. A few cosmetic upgrades can transform a home into something truly special and potentially add value to the property. In addition, don’t rule out older homes or those with a plethora of construction detail just because they require more regular maintenance. In the long run, the extra work will likely be worth it.

3. Know Your Must-Haves and Nice-To-Haves

When buying a home, it can be easy to get carried away with fantasies about what your dream house should look like. This is why it is important to keep a clear and concise list of your must-haves and nice-to-haves in mind as you start searching for your perfect home.

This will help you avoid getting frustrated and giving up on the home buying process altogether. It will also make it easier to compromise with your real estate agent when it comes time to find the right home for you.

If you are unsure of what your must-haves are, think about the things in life that are most important to you. For example, if you have children, then the number of bedrooms and bathrooms is probably a non-negotiable feature. Other things that may be non-negotiable include a spacious kitchen, large backyard, and enough storage space.

Similarly, you should have a clear idea of what is important to you when it comes to the neighborhood. Research everything you can about the area including schools, transportation, traffic, and the overall vibe of the community. This will help you narrow down the search for your dream home and avoid wasting time looking at homes that are not even in the same city or state.

It is also helpful to take the time to understand the area’s property tax rates, crime rate, and the distance between your future home and your work and school. This will give you an idea of the commute and the amount of travel expenses you can expect in the future.

4. Research the Area

Buying a home isn’t just about visiting model homes or browsing real estate listings. It’s about the location, community, and lifestyle that suits your family and your needs.

Before you start looking at houses, make a list of what you’re hoping for in your dream home. It’s important to distinguish between “must-haves” and “nice-to-haves.” This will help you stay within your budget and avoid falling in love with a property that you simply can’t afford.

When you create your list, consider things like how many bedrooms and bathrooms you want, the size of the kitchen and living area, and whether you need a yard for kids or pets. You should also take into consideration the overall neighborhood and how close it is to your work, schools, or any other amenities you enjoy.

It’s also a good idea to visit the neighborhood at different times of day to see what it’s really like. It’s important to be aware of noise levels, traffic, and how close you will be to your neighbors.

If you find the perfect house that fits your criteria, it’s important to have a professional inspection done before making any offers. This will give you a complete idea of the current condition of the home and any potential problems that may arise in the future. This can save you a lot of headache down the road. Taking these steps will put you well on your way to finding your dream home!

5. Set a Schedule

When it comes to shopping for houses, it’s important to set a schedule. This will help you avoid wasting time seeing properties that don’t meet your criteria. Start by making a list of your “must-haves” and your “nice to haves.” “Your must-haves are the things that are non-negotiable for you, such as the number of bedrooms needed for a growing family or the location of the property within the school district,” says Sobh. “Your nice to haves are the features you’d like to have in a home but aren’t necessarily critical.”

You’ll also want to make sure you bring an open mind to house tours, as your needs and preferences may change once you actually see a property. Also, be prepared to take notes during the tour. Lastly, don’t forget to ask your agent about the neighborhood—including traffic patterns, future zoning and infrastructure changes and the local crime rate.

6. Schedule a Tour

While finding a home that fits your budget is essential, it’s also important to find a neighborhood that truly meets your lifestyle needs. Consider the quality of local schools if you have kids, or whether there are hiking and jogging trails nearby for those who love being outdoors. Likewise, it’s important to take the time to drive or walk around neighborhoods at different times of day to get a feel for how quiet or noisy a particular area is.

When viewing homes, it’s a good idea to bring a floor plan and write down dimensions, especially closet space. Many real estate websites, like StreetEasy, include these details in a property’s description, but you can also ask the listing agent for one or request it from your realtor. Once you have a floor plan, you can mark off which rooms are non-negotiable and which ones you might be willing to compromise on.

It’s also a good idea to write down your dream home wish list, such as having the master bedroom on a separate level or having enough space for a woodworking hobby. This will help you narrow down your search and eliminate houses that won’t meet your family’s needs. Plus, it can help you avoid “list creep”—the tendency to add items to a house that didn’t initially make the cut. This is a sure way to waste precious days and weeks in the real estate market.